Source prnewswire

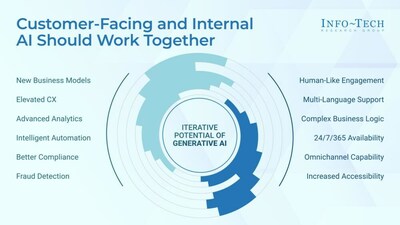

The AI-Driven Banking Surge: Info-Tech Releases New Research on the Future of Small and Midsize Institutions

It is November 1st in Toronto. In response to the rapid adoption of artificial intelligence (AI) and machine learning (ML) in the banking industry, particularly in terms of the impact on customer experience and internal operations, financial institutions are on the verge of a transformative era in response to the rapid adoption of these technologies.. A global IT research and advisory firm, Info-Tech Research Group, has released its latest industry research blueprint, AI/ML for Small and Midsize Banks, in order to assist banks and business leaders in navigating the current landscape of banking services.. With the urgency to integrate AI/ML becoming paramount, institutions are eager to move forward, but often have misgivings about their current AI/ML strategies and their future plans as a result. The firm's new research encompasses everything from improving customer interactions to streamlining internal processes, with the goal of helping banks understand the multifaceted benefits of artificial intelligence in order to stay at the forefront of this technological revolution for years to come The firm's new research encompasses everything from improving customer interactions to streamlining internal processes, with the goal of helping banks understand the multifaceted benefits of artificial intelligence in order to stay at the forefront of this technological revolution for years to come "The use of artificial intelligence and machine learning (AI/ML) in retail banking is rapidly growing as a result of advances in technology. David Tomljenovic, the head of the financial services industry research at Info-Tech Research Group, said: "The early-adopter banks are establishing themselves as industry leaders and are redefining the experience and expectations for all banking customers.". In our experience, customers are responding positively to the ease of use, accessibility, and personalization that AI/ML-powered experiences can provide. There is a necessity for banks to modernize their customer experience (CX) using these new techniques if they don't want to risk losing their customers to banks that are utilizing them." " There has been a rapid acceleration in the use of artificial intelligence and machine learning (AI/ML) in retail banking over the past several years. There is no doubt that early-adopter banks are establishing themselves as industry leaders and are redefining the behavior and expectations of all banking customers," says David Tomljenovic, head of financial services industry research at Info-Tech Research Group.. It has been reported that customers are responding positively to the ease of use, accessibility, and personalization that an AI/ML-powered experience delivers. In order to remain competitive, banks must modernize their customer experience (CX) using these new techniques or they risk losing their customers to banks that do not use them In order to remain competitive, banks must modernize their customer experience (CX) using these new techniques or they risk losing their customers to banks that do not use themInformation Technology emphasizes that the banking sector needs to develop a tailored AI and ML strategy, advocating for a diagnostic approach to identify each bank's unique requirements and capabilities, rather than merely trying to achieve benchmarks of peak maturity in AI and ML. According to the firm, as AI and machine learning technologies become increasingly intertwined with the core of banking operations and customer experiences, it is crucial to strike the right balance between innovative advancements and the potential challenges that may arise as a result. By maintaining a balance between these two aspects, banks are not only able to stay competitive but also maintain the trust and satisfaction of their clients in the long run By maintaining a balance between these two aspects, banks are not only able to stay competitive but also maintain the trust and satisfaction of their clients in the long runThe firm's research indicates that when internal and external AI benefits are strategically combined, they can build on each other and lead to exponential benefits. As a result of this integrated approach, banks not only improve customer interactions, but also optimize their internal processes, resulting in increased efficiency and growth overall. As outlined by Info-Tech research, small and midsized banks will reap a number of benefits when implementing a machine learning and artificial intelligence strategy:Nevertheless, the research conducted by Info-Tech highlights the potential of AI and machine learning in the banking sector, both in terms of improving customer interactions and in terms of strengthening internal operations.. Nevertheless, the firm cautions that the key to a successful implementation of these technologies is not merely the adoption of these technologies at a rapid rate, but rather understanding and integrating them with a bank's mission and clientele in a way that is meaningful to both. It is essential that institutions balance innovation with practicality as AI and machine learning technologies become more integrated into core banking operations. So that banks can provide a seamless, modern experience to their customers while optimizing their internal processes to meet the challenges of tomorrow, by doing so, they can ensure they deliver a seamless, modern experience for their customers So that banks can provide a seamless, modern experience to their customers while optimizing their internal processes to meet the challenges of tomorrow, by doing so, they can ensure they deliver a seamless, modern experience for their customersIf you would like to obtain exclusive and timely commentary from financial expert David Tomljenovic or if you would like access to the complete AI/ML for Small and Midsize Banks research, please contact Senior PR Manager Sufyan Al-Hassan at [email protected]. Founded in 1998, Info-Tech Research Group is a leading global provider of information technology research and advisory services, serving over 30,000 IT professionals around the globe. It is the company's goal to produce unbiased and highly relevant research to assist CIOs and IT leaders in making strategic, timely, and well-informed decisions about their organizations. In the past 25 years, Info-Tech has partnered closely with IT teams to ensure that their teams are supported with everything they need, from actionable tools to analyst guidance, allowing them to produce measurable results that matter to their organizations. In the past 25 years, Info-Tech has partnered closely with IT teams to ensure that their teams are supported with everything they need, from actionable tools to analyst guidance, allowing them to produce measurable results that matter to their organizations.Through the firm's Media Insiders program, media professionals can gain access to unrestricted access to the firm's IT, HR, and software research as well as over 200 IT and industry analysts, as well as over 200 analysts across all industries. For more information, please contact [email protected].To find out more about Info-Tech Research Group, as well as to view the latest research, please visit infotech.com and connect via LinkedIn and X.The Info-Tech Research Group is the source of this informationCIO Awards are given to IT leaders who have demonstrated excellence in Info-Tech Research Group's Business Vision diagnostic, highlighting their key contribution to their organizations...A leading research and advisory company has announced the implementation of a comprehensive business continuity plan designed to strengthen and streamline recovery processes in the...If you want to receive PRN's top stories and curated news delivered directly to your inbox on a weekly basis, sign up now!

No Comments