Source prnewswire

IDTechEx Reveal the Future of EVs: Evolution of the Automotive Industry and Electrification Beyond Cars

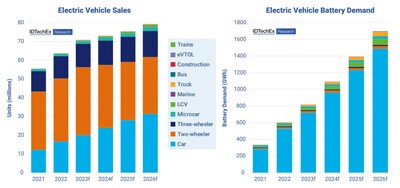

EVs (electric vehicles) are expected to be one of the fastest-growing segments of the market in 2023. According to IDTechEx, global sales of electric cars rose by 62% from 2021 to 2022, and IDTechEx estimates that sales will rise by another 16% by 2023 compared to 2021.. The growth of plug-in hybrids (PHEVs) in Europe in the first half of 2023 was somewhat hindered by the poor performance of plug-in hybrids (PHEVs) in the first half of 2023, with subsidy phase-outs starting in Germany.. It is important to note that even with a slower growth rate than previous years, many will agree that electric vehicles are the future, particularly in the passenger car sector. Is there anything else that can be learned about the future of electrification? Is there anything else that can be learned about the future of electrification? In spite of the fact that the electric car has now become a common phrase in the public's vocabulary, there are still certainly a number of significant technological and market trends happening in the automotive industry today. Additionally, electrification is rapidly taking off in many other segments of the vehicle industry, including all kinds of vehicles on the road (vans, trucks, buses, 2-wheelers, 3-wheelers, microcars...), as well as many off-road segments, such as construction vehicles and trains. In spite of the fact that the electric car has become an everyday term among the general public, there are still significant technological and market trends that have yet to be realized in the automotive industry as a whole. As well as this, there are a number of other segments of the vehicle industry where electrification is on the rise; these include not only vehicles that are on the road (vans, trucks, buses, 2-wheelers, 3-wheelers, microcars...) but also off-road segments like construction vehicles and trains that are being electrified.Aside from vehicles on land, there are also sectors within the marine sector (boats, ships, etc.).Air taxis (eVTOLs) and other aerial vehicles like drones are gaining increased interest in the market and gaining ground. It should be noted that every vehicle category is at a different stage when it comes to electrification, and has its own technology and market demands based on several factors, including technical feasibility, consumer acceptance, government policies, and several others.. It is the goal of this article to provide an overview of the electrification of several vehicle sectors and what can be expected over the next ten years in terms of electrification. A recent report by IDTechEx predicts that the number of electric vehicles sold annually across all segments mentioned above will double by 2034. This is partly due to the fact that the number of electric two- and three-wheelers already on the market is stagnating in some of the major markets;. The battery demand, however, increases by more than seven times as well.There was a sevenfold increase in the same period, primarily driven by the car market, but with other segments also contributing significantly to the growth.There was a sevenfold increase in the same period, primarily driven by the car market, but with other segments also contributing significantly to the growth.Increasingly, technology companies are becoming suppliers to the automotive industryThere is no doubt that Tesla is a leader in the EV space, and it has changed the way that many think about cars as a product, as a result of its impact on many consumers. As a matter of fact, the sales process for this type of product is more akin to purchasing any other consumer electronics product than the typical car buying process. Moreover, the ownership model of electric cars has also evolved into a more mobile one. Many electric vehicles now provide over-the-air updates so that the car's systems can be kept up to date, whereas, for instance, many traditional automakers would have had to do this during a service, and have been known to charge a high fee to update satellite navigation maps, something that is becoming standard to update for free remotely.. A number of vehicles now come with features that can be added at a later date or subscribed to at a later time A number of vehicles now come with features that can be added at a later date or subscribed to at a later timeIn light of this new trend towards cars that look more like mobile phones than cars, major technology companies have taken an interest in the car market and, rather than supplying small components, they are looking at providing the whole car as a whole.A prime example of this approach was Huawei, who launched its SERES SF5 model in China in 2021. After many years of exhibiting automotive-related technology, Sony has entered into a joint partnership with Honda in order to provide vehicles with a 2026 production date. Other examples that have announced projects include Xiaomi, Baidu (a joint venture with Geely), Foxconn, and others. Apple scaled back on its fully autonomous car project, however, rumors persist about an electric car project.There were a few key issues Tesla had at the beginning that had nothing to do with the technology of the vehicle itself, but rather with the scaling up and quality control that are associated with manufacturing cars in large quantities, something that traditional automakers have a tendency to excel at.. There are a number of reasons why these tech companies have often partnered with traditional automakers or other large manufacturers who have experience in the automotive industry because of this. As a result of this sort of approach, we might see yet another change in how the automotive market is structured, with traditional OEMs producing the vehicles and tech companies providing the software and integration for them. Ultimately, this would benefit the end user in the form of a well-built vehicle that integrates seamlessly with all of their other electronic devices as well Ultimately, this would benefit the end user in the form of a well-built vehicle that integrates seamlessly with all of their other electronic devices as wellIn order to meet the demand for electric vehicles, the charging infrastructure needs to growGlobally, the market for electric vehicle charging infrastructure is growing steadily. IDTechEx reports that in 2022, nearly 2.7 million public charging stations will be available worldwide. Nearly 960k chargers will be installed in that same year globally. A total of 222 million chargers will be needed by 2034 to support the growing fleet of electric vehicles worldwide. By 2034, IDTechEx predicts that the cumulative global investment in charging infrastructure will total over US$123 billion (hardware cost alone).It is undeniable that there is a huge push to establish public DC fast charging networks throughout the world. As of now, China is leading the race with one.A total of 797 million public chargers have been deployed in the world, taking up 70% of the global market. Under the National Electric Vehicle Infrastructure (NEVI) Formula Program, the US government will provide more than $5 billion in funding and incentives to build a coast-to-coast fast charging network for electric vehicles.. The Alternative Fuels Infrastructure Regulation (AFIR) in the EU is also contributing to the growth of public charger installations by mandating a station every 60km along the highways in the EU. A recent report from IDTechEx predicts that DC fast chargers will show a higher growth rate in the coming decade, although AC chargers will continue to dominate the market by unit volume for the next decade A recent report from IDTechEx predicts that DC fast chargers will show a higher growth rate in the coming decade, although AC chargers will continue to dominate the market by unit volume for the next decadeGlobally, the EV charging network remains fragmented, with numerous chargepoint operators vying for market share in the different regions of the world. It was recently announced that leading automakers have adopted Tesla's North American Charging Standard (NACS) charging connector for their vehicles in the United States. Currently, Tesla operates the largest public DC charging network in the world, and in North America, NACS outnumbers CCS (combined charging standard) two to one, which explains the company's decision to use Tesla's standard.. Additionally, the network is more reliable and has 20-70% lower deployment costs than their competitors due to the fact that the components are designed and manufactured in-house by the company. Having said that, from a technical standpoint, Tesla's connector is lightweight, is capable of supporting AC and DC through shared pins, and features immersion cooled cables, which allow the connector to support higher amperages. As per IDTechEx's forecast, cars and other EV supply equipment supporting CCS will account for less than 50% of the market share in the US by the end of the decade, even though it will continue to be the dominant standard throughout the EU and UK. As per IDTechEx's forecast, cars and other EV supply equipment supporting CCS will account for less than 50% of the market share in the US by the end of the decade, even though it will continue to be the dominant standard throughout the EU and UK.There is a possibility that electric trucks will become a standard method of transporting goodsDespite the fact that the electric truck market is still in its infancy in Europe and the US, data from the European Alternative Fuels Observatory (EAFO) indicates that only 1,607 electric trucks were registered in the EU27 countries as of 2022, while estimates suggest that there are approximately 3,000 electric medium and heavy-duty trucks on the roads of the United States in total.. It must be noted, however, that all of the major OEMs have ongoing projects involving electric trucks that are intensifying, and that all manufacturers recognize that the transition to zero-emission powertrains has begun.. The number of electric heavy trucks sold in China reached an all-time high in 2022, totaling 25,072 units, an increase of 140% over the previous year. The number of electric heavy trucks sold in China reached an all-time high in 2022, totaling 25,072 units, an increase of 140% over the previous year.From 2021 until the end of 2022, model availability has increased by nearly 65% (from 182 models to 299). In terms of model availability, heavy-duty trucks (HDT) have experienced the most robust growth in availability from 2021 to 2022 (57 models to 111 models), demonstrating a 95% increase as technology advances over the last decade. Between 2021 and 2022, the number of medium-duty trucks (MDTs) grew by 50% year-over-year. Zero-emission heavy-duty trucks have shown initial promise for urban freight and short-haul operations of under 150 miles per day.It appears that Tesla, Daimler, VW, and Volvo are investing heavily in battery-electric trucks, and they are winning the battle in terms of their total cost of ownership (TCO).. As well as Toyota, Hyundai, and Nikola, some companies have decided to focus their efforts on fuel cells (FC).. Although there are issues with the efficiency of hydrogen as a fuel, FCEVs continue to be considered as a technology for long-haul trucking applications, where a large range is required, despite issues with hydrogen's efficacy. As a result of current barriers, such as the high upfront price of a vehicle, the high price of hydrogen, as well as an insufficient hydrogen refueling network, there is still hope for the future As a result of current barriers, such as the high upfront price of a vehicle, the high price of hydrogen, as well as an insufficient hydrogen refueling network, there is still hope for the futureThe construction of at least 12 commercial EV megawatt (MW) power level charging projects is currently underway or on schedule to begin within the next few years. As of 2021/22, these projects have been announced, with disclosed investments exceeding $1 billion.There are two billion people in the world. It is the goal of many projects to operate MW-scale chargers in order to support the adoption of battery electric trucks as soon as the relevant MCS standard has been finalized. IDTechEx predicts that MW charging for commercial vehicles will see rapid growth in the next few years, but it will remain a very small part of the overall market for charging infrastructure in general IDTechEx predicts that MW charging for commercial vehicles will see rapid growth in the next few years, but it will remain a very small part of the overall market for charging infrastructure in generalAir taxi services will be enabled by the use of eVTOL aircraftThe number of companies building full-scale, flying, eVTOL aircraft (electric vertical take-off and landing) is increasing as the technology improves. There have been a number of successful test flights and trials of eVTOL prototypes. There is still a considerable amount of work to be done, especially to improve the battery performance, in order to enhance the practical capabilities of eVTOL aircraft for application in the real world. There are a number of eVTOL OEMs that have started working with the civil aviation authorities in an effort to pursue certification of their commercial eVTOL passenger aircraft. It has been reported that a majority of manufacturers are currently testing prototypes and intend to launch commercial services in the period between 2024 and 2026 following successful flight certifications. Based on the tracking IDTechEx has been doing over the years, it seems that eVTOL commercial launch dates are being pushed back incrementally due to regulatory hurdles rather than technological ones Based on the tracking IDTechEx has been doing over the years, it seems that eVTOL commercial launch dates are being pushed back incrementally due to regulatory hurdles rather than technological onesAn overview of the timelines for eVTOL companies looking to start commercial production. Source: IDTechEx chart based on 29 announcements from 29 companies. A study by IDTechEx concludes that intracity airports are not the ideal environment for eVTOL air taxi operations because short flights are expensive; eVTOL trips less than 40 km do not offer any advantages in terms of time; there is no available space for, and the cost of land for vertiport construction; and there is the hazard of operating in and above populated cities that all pose major obstacles.. The ability to fly autonomously over longer distances (>50km) will be crucial to making air taxi services cost-competitive, and almost all eVTOL OEMs are looking forward to adding this capability to their air taxi systems. VTOL taxis would not only be faster over this range of distances, but they also have the potential to be cheaper than other modes of transportation as well. In spite of this, the process of building, certifying, and flying such an aircraft remains very costly, uncertain, and competitive. According to industry estimates, the cost of developing one and certifying it will be around US$1 billion in total According to industry estimates, the cost of developing one and certifying it will be around US$1 billion in totalIn order for the eVTOL air taxi market to make significant progress within the next ten years, IDTechEx does not expect it to make a lot of progress in the first ten years, but instead forecasts a strong growth later in the decade as more players become certified.There are many segments of the vehicle industry that are electrifyingIDTechEx's report "Electric Vehicles: Land, Sea & Air 2024-2044" is a comprehensive report that covers nine EV markets with more than 126 forecast lines, encompassing nine EV markets in total. The scope includes all vehicle volume and drivetrain breakdowns, including battery-electric, fuel cell, and hybrid vehicle unit sales, battery demand (GWh), and revenue generation ($ billion) of the market.The report further details the emerging technology trends underpinning the transition, including silicon-anode batteries, axial-flux motors, and megawatt DC fast-charging. You can find more details at www.IDTechEx.com/EV. Additional drill-down reports can be found at www.IDTechEx.com/Research/EV. Additional data, analysis and insights can also be accessed through bespoke subscription services that IDTechEx offers – you can find out more at www.IDTechEx.com/Subscriptions.This article is taken from "Technology Innovations Outlook 2024-2034", a complimentary magazine of analyst-written articles published by IDTechEx that provides insights into a wide range of technology innovation areas, assessing the landscape now and giving you an outlook for the next decade. At www.IDTechEx.com/Magazine, you will be able to read the magazine in its entirety.IDTechEx - a brief overview You can profit from emerging technologies if you leverage IDTechEx's Research, Subscription and Consultancy products, which help you make strategic business decisions by helping you get the most out of emerging technologies. For more information, please contact [email protected] or visit www.IDTechEx.com. There are a number of free webinars coming up that you can attendIn the next few weeks, IDTechEx analysts will be presenting four webinars which may be of interest to you. Please click on the titles to register for one of the three sessions.You can download the images by clicking on the following link: https://www.dropbox.com/scl/fo/s8bf0usakkoopfqt2xef9/h?rlkey=lvpkba2ddtorg0nt5w80a2w2l&dl=0Contact information for the media is as follows: The marketing and sales administrator for Lucy Rogers is Lucy Rogers at [email protected] +44(0)1223 812300. The following are links to social media sites: You can find IDTechEx on Twitter at https://www.twitter.com/IDTechEx and on LinkedIn at https://www.linkedin.com/company/idtechex This photo can be found at: https://mma.prnewswire.com/media/2282716/IDTechEx.jpgLogo can be found at: https://mma.prnewswire.com/media/478371/IDTechEx_Logo.jpgIDTechEx is the source of this informationAs conductive additives at the cathode of lithium-ion batteries (LiBs), carbon nanotubes (CNTs) are gaining significant traction as a conductive additive within the lithium-ion battery market, a market driven by the...Each decade, there is a new generation of telecom technology emerging, the most recent being 5G, which offers faster data rates, low latency, and enhanced security...Get PRN's top stories and curated news delivered straight to your inbox every week when you sign up for our newsletter!

No Comments