Source prnewswire

Omni Logistics Board of Directors Issues Letter to Forward Air Shareholders

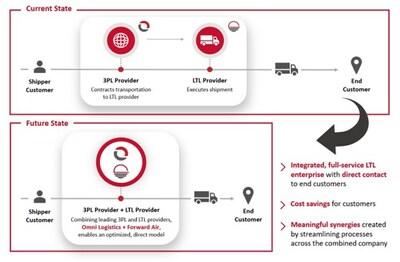

The Board of Directors of Omni Logistics ("Omni"), a technology-driven provider of global multimodal logistics solutions and specialized services, today issued a public letter to shareholders of Forward Air Corporation ("Forward Air"), a company that provides global multimodal logistics solutions and specialized services.### I am writing to you as a shareholder of Forward Air.The merger of Omni Logistics and Forward Air has received a lot of attention in recent weeks, particularly due to the merger. Having the opportunity to speak directly with Omni's Board of Directors about Omni, the background of the transaction, the compelling financial and strategic rationale for the merger, as well as the future plans for the combined company is of the utmost importance to Omni shareholders.A simple yet powerful thesis underlies the proposed merger between Omni and Forward Air: it is aimed at creating an integrated global logistics service company that can provide comprehensive logistics solutions globally. This is the rationale articulated by both parties when the transaction was announced in August, and the rationale is still as strong today as it was then. As the owners of Forward Air, we are confident that you can capitalize on the tremendous potential to create value from the combined company in order to realize significant upside.Since we will be significant shareholders in the combined company, our incentives will also be fully aligned with yours. We remain deeply confident that Omni and Forward Air will be an industry-defining force together. Despite the fact that we are confident, we have received overwhelmingly positive feedback from customers across the value chain, who have increased their business with both companies since the announcement of the merger, anticipating the unique value proposition our combined platform will provide.Is there a reason why we are fighting for such a combination?There has been a constant lesson in our decades of experience: if you take care of your customers, you are taking care of the long-term value of your stock. Throughout our decades of experience, there has been one constant lesson – if you take care of your customers, you are taking care of the long-term value of your stock.It is worth fighting for this transaction because it is the best solution for customers. In this combination, Forward Air has the opportunity to make a seismic shift in the industry and "change the model." This would allow Forward Air to communicate directly with customers instead of relying on an intermediary, creating a direct relationship between them and the company. In this way, a layer of cost is removed, and the customer benefits.Our goal is not to exit this transaction as quickly as possible. The transaction is not for cash - it is for equity in the combined company going forward. We are committed to this transaction, and we are here for the long haul.What we do and who we areOmni specializes in asset-light freight forwarding, with a track record of growth and value creation that is unmatched in the industry. As Omni has grown in the past eight years, its customer base has grown from 500 to approximately 7,000, and nearly two-thirds of its largest customers use Omni for a variety of services with very high retention rates - Omni's top 50 customers have been with Omni for more than 10 years on average.. Omni has received a variety of awards for its success in the logistics industry, including being named one of the top 100 logistics providers in the industry by Inbound Logistics and Transport Topics, and its leaders have been recognized with honors by outlets such as the Dallas Business Journal and 3BL Global. Omni has received a variety of awards for its success in the logistics industry, including being named one of the top 100 logistics providers in the industry by Inbound Logistics and Transport Topics, and its leaders have been recognized with honors by outlets such as the Dallas Business Journal and 3BL Global.It is a privately held company, whose shareholders are a group of highly experienced and well-capitalized institutional investors with specific expertise in the area of transportation and logistics, whose expertise can be found in Omni.. In total, Omni shareholders represent billions of dollars in assets under management, along with decades of experience building and growing leading companies. Shareholders of the company have invested through multiple cycles, have significant capital available, and remain committed to ensuring the success of the business no matter what the current economic climate or industry dynamics may be. Shareholders of the company have invested through multiple cycles, have significant capital available, and remain committed to ensuring the success of the business no matter what the current economic climate or industry dynamics may be.An overview of the transaction's background There was no intention to sell Omni when Forward Air proactively approached Omni in early 2023 about a strategic combination, as Omni was not on the market.. Over the years, Omni has been approached by a number of world-class logistics companies and investment firms in order to acquire the company. Due to the fact that none of these options would have enabled Omni to accelerate its growth faster than it could on its own, Omni's Board of Directors did not pursue these opportunities. Nevertheless, the merge with Forward Air represented a transformational transaction from the Omni Board's perspective, which is why we responded to Forward Air's outreach and worked in good faith towards the completion of the merger Nevertheless, the merge with Forward Air represented a transformational transaction from the Omni Board's perspective, which is why we responded to Forward Air's outreach and worked in good faith towards the completion of the mergerI have always had a great deal of respect for Forward Air, the talented employees it has, and the customer service it offers. Having maintained an extensive commercial relationship for decades, Omni and Forward Air share a common understanding of the industry dynamics which are promoting integrated solutions and direct customer relationships. The two companies know one another very well.As part of Forward Air's multi-year "Grow Forward" initiative, the company wanted to increase its ability to work directly with shippers, as the majority of its current customer relationships are with intermediaries, such as Omni Express - Forward Air's largest LTL customer.. It is apparent that the industry has been rapidly evolving towards a more integrated service model for the benefit of its customers. In order to expand its serviceable market, Forward Air has realized that it must develop direct solutions that will serve small- and medium-sized shippers who would not otherwise work with forwarders in order to serve their needs In order to expand its serviceable market, Forward Air has realized that it must develop direct solutions that will serve small- and medium-sized shippers who would not otherwise work with forwarders in order to serve their needsDuring the same period, Omni had embarked on a multi-year growth strategy that focused on establishing itself as the leading technology-enabled provider of logistics solutions for customers with high-value freight, with a particular emphasis on driving density and scale within its growing network of domestic ground LTL carriers.. A key part of Omni's strategy has been the development of Omni's proprietary LTL network, which has enabled the company to win customers and lower its unit costs as a result.. With the merger with Forward Air, Omni would have the opportunity to significantly accelerate its long-term growth strategy as well, as Forward Air is the leader in domestic expedited LTL services With the merger with Forward Air, Omni would have the opportunity to significantly accelerate its long-term growth strategy as well, as Forward Air is the leader in domestic expedited LTL servicesThere is an opportunity for both companies to achieve their strategic goals through this partnershipBringing together the most extensive LTL network for expedited freight with the premier high value freight forwarder checks all the boxes for customers: our belief is that the combined company will have the best capabilities and quality of service, as well as eliminating a significant layer of cost and complexity, so that the lowest unit-cost provider can be found.. I am sure any casual observer of the global supply chain would agree that in the past few years of supply chain disruption and volatility, customers' demands for greater reliability and lower costs have accelerated as a result of these factors. With the new and vertically integrated company, shippers will have a more efficient, differentiated, and indispensable partner in the shipping industry With the new and vertically integrated company, shippers will have a more efficient, differentiated, and indispensable partner in the shipping industryBy virtue of this transformational combination, shareholders will be able to benefit from opportunities that can only be achieved through a combination of these two companies:Together, we can achieve long-term prosperity and prosperity for allThis belief in the power of combining words on a page is not the only area in which we believe in the power of combination.Since Omni shareholders were enthusiastic about Omni's standalone value creation plan and the compelling rationale of the Forward Air transaction, it was critical that the transaction be structured with meaningful equity consideration, given Omni's own shareholders' enthusiasm for Omni's standalone value creation plan.. This is not a "cash out" deal - the majority of the proceeds for Omni shareholders come in the form of Forward Air's stock, which will result in Omni shareholders becoming significant minority owners of the combined company as a result of this deal.. There was an intentional reason for this: Omni shareholders strongly believe in the value creation opportunity of the combination, and they are placing a big bet on that future success. There was an intentional reason for this: Omni shareholders strongly believe in the value creation opportunity of the combination, and they are placing a big bet on that future success.As Forward Air shareholders, we empathize with you as you have suffered a loss in value since the announcement of the deal was made. According to Forward Air's current trading levels, Omni's shareholders' equity value has decreased by approximately $700 million in aggregate as compared to the value when the transaction was announced, based on Forward Air's current trading levels.However, Omni has not attempted to renegotiate or renege on the transaction as a result of this.. The fact that some Omni shareholders have acquired additional shares of Forward Air stock speaks volumes about their conviction in the future of the combined company. The fact that some Omni shareholders have acquired additional shares of Forward Air stock speaks volumes about their conviction in the future of the combined company.The Board of Directors of Omni consists of long-term and deeply committed investors who strongly believe that the combined company will have numerous levers to maximize shareholder value in the future, including:In the light of this, where do we go from here?There is still a 100% commitment by the Omni Board to closing the Forward Air transaction. Together, these two companies will be able to create greater value for customers and the combined company will be able to serve customers in the best possible way in a reshaped LTL industry. We look forward to continuing the conversation with you so that we may maximize the potential of the future company as well as our respective stake in it.Board of Directors of Omni Logistics Inc.###The company is advised by the following law firms: Alston & Bird, LLP; King & Spalding LLP; Wachtell, Lipton, Rosen & Katz; Potter Anderson & Corroon LLP; Goldman Sachs & Co. LLC; and J.P. Morgan Securities LLC.Omni Logistics - What we doAs a global multimodal provider of air, ocean, and ground logistics, Omni Logistics offers a wide range of services. We design each supply chain solution based on the specific needs, challenges, and objectives of each customer, regardless of the mode, the time requirements, or the cost of the solution. As a global logistics company with a global workforce spread over more than 100 locations, Omni Logistics is focused on eliminating supply chain inefficiencies and delivering low-cost-per-unit solutions to approximately 7,000 customers all over the world by utilizing the expertise and advanced training of an expansive global workforce at over 100 locations.. In addition to providing a full range of multimodal solutions both domestically and internationally, Omni Logistics also manages a robust portfolio of supplemental services for enterprises that depend on the efficient movement of high-value freight on a regular basis In addition to providing a full range of multimodal solutions both domestically and internationally, Omni Logistics also manages a robust portfolio of supplemental services for enterprises that depend on the efficient movement of high-value freight on a regular basisStatements that are forward-lookingIt is important to note that this press release includes forward-looking statements which are based on information Omni has at this time, Omni's beliefs, as well as a number of assumptions concerning future events that Omni believes may occur.. As a result, forward-looking statements are not a guarantee of future performance, as they are subject to a number of uncertainties and other factors, which could cause the actual results to differ materially from what is currently anticipated.. It is important to note that in providing forward-looking statements, the company does not intend, and does not assume any obligation or duty, to update those statements as a result of new information, future developments or other factors. It is important to note that in providing forward-looking statements, the company does not intend, and does not assume any obligation or duty, to update those statements as a result of new information, future developments or other factors.Contact information for the mediaIn this case, Jeremy Fielding, Nathan Riggs and Mark FallatiKekst CNC [email protected]Assumed that Forward Air's closing share price on August 9 (the day before the announcement of the transaction) was $110.00 and that Forward Air's closing share price on November 16 was $64.76,The source of this information is Omni Logistics, LLCOmni Logistics ("Omni"), a technology-driven provider of global multimodal logistics solutions and specialized services, issued a statement to the media stating that...In a recent announcement, Omni Logistics ("Omni"), a technology-driven provider of global multimodal logistics solutions and specialized services, announced it has launched a new augmented reality application...Receive PRN's top stories and curated news delivered directly to your inbox every week when you sign up!

No Comments